Life Insurance in and around Springfield

Get insured for what matters to you

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Protect Those You Love Most

The average cost of funerals in this country is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for your family to cover those costs as they mourn. That's where Life insurance with State Farm comes in. Having the right coverage can help those closest to you pay any outstanding bills and not end up with large debts.

Get insured for what matters to you

Life won't wait. Neither should you.

Why Springfield Chooses State Farm

And State Farm Agent Paul Clark is ready to help design a policy to meet you specific needs, whether you want level or flexible payments with coverage designed to last a lifetime or coverage for a specific number of years. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

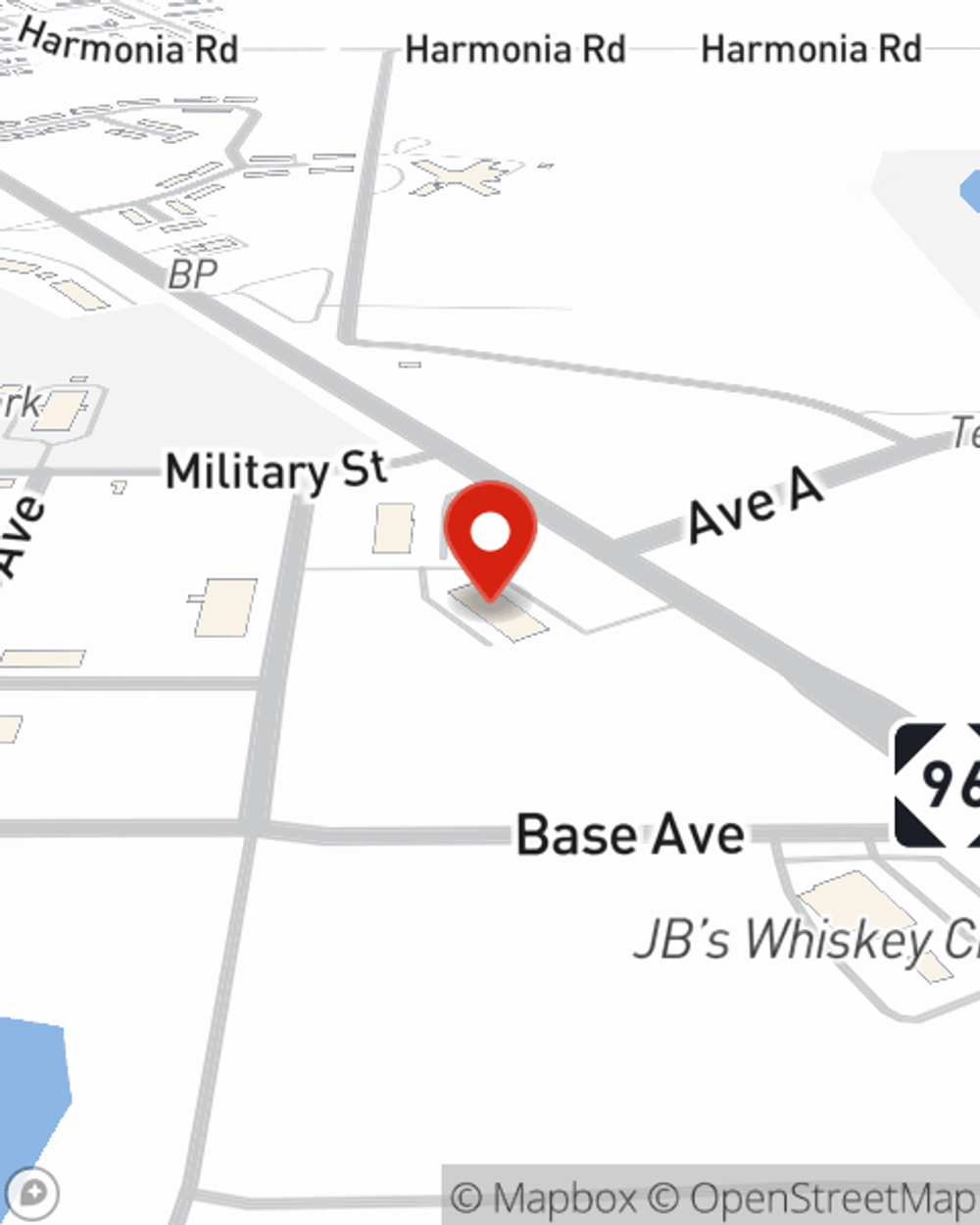

Interested in learning more about what State Farm can do for you? Visit agent Paul Clark today to get to know your unique Life insurance options.

Have More Questions About Life Insurance?

Call Paul at (269) 883-6909 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.